Enjoy short-term solutions with long-term protection

Whether it’s for personal protection or commercial cover, safeguarding your assets is a highly specialised field. As an advice-led advisory business that understands this requirement, Consult partners with more than 50 short-term specialist advisers to ensure that clients’ unique needs for asset protection are appropriately met. Wherever you are on your insurance journey, our team helps you build the perfect portfolio through evaluation, management and risk optimisation. Thanks to our digital advice process, Consult Advisers can leverage technology to establish a client’s needs, then compare quotes of various product providers to create a digital record of advice and well-documented asset protection plan.

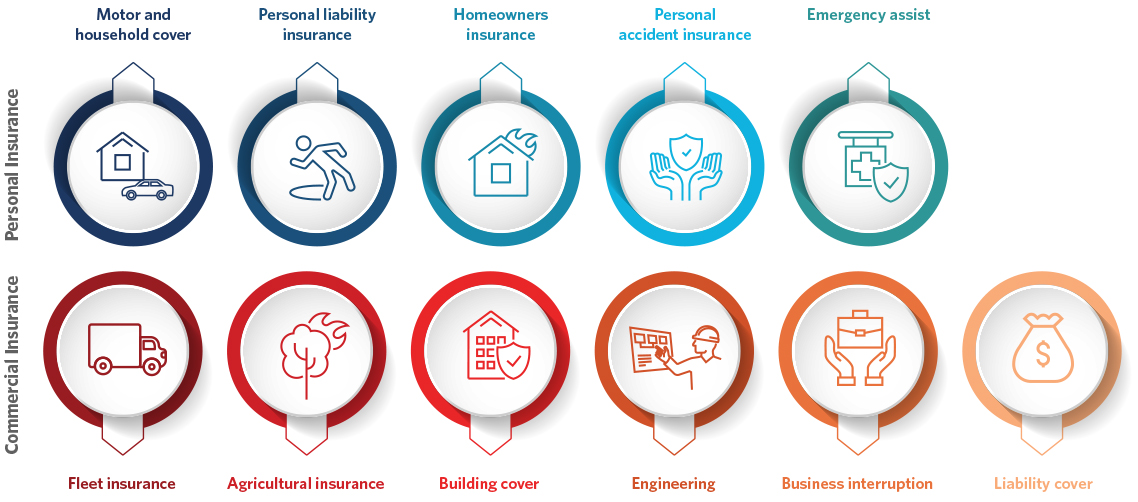

Business and personal options to cover all your needs

By tapping into our extensive network of reputable providers, our advisers can help you plan a commercial or personal short-term insurance roadmap to take you into the future. Personal insurance helps you protect your assets and gives you peace of mind. Commercial insurance helps businesses stay protected against risks that could impact their success.

Consult clients benefit from our digital ecosystem

We help our advisers and clients connect in a digital-first world without losing the human touch needed when it comes to discussing insurance. Through our digital short-term insurance ecosystem, we provide:

.png) |

A digital needs-based advice process that includes multiple quotes for the most objective and transparent choice of provider | |

.png) |

Access to a strong administrative partner that provides support on underwriting, discounts, claims and recoveries | |

.png) |

An effective client support and self-service portal |

Chat to your specialist short-term adviser about Consult Insure - an app that brings all your short-term insurance needs into one place - putting you in charge of your insurance journey and in contact with your adviser.